Every month, I post a report of our expenses to show that it is possible to live a comfortable, exciting, and adventurous life without breaking the bank. The less money you spend, the less you need to make. 🙂

This report includes ALL of our expenses, in US$, for two adults and one 60-pound dog (we adopted Maya on June 4th, 2019). Under groceries we incorporate food, produce, and non-alcoholic drinks predominantly bought in supermarkets. Toiletries belong in that category as well. Dining out means eating at a restaurant/event or purchasing take-out food. The health category covers non-prescription medicines and vitamins/supplements; medical contains prescription drugs and doctor’s visits. Because of our income level, Mark and I are eligible for free health care within the state of Massachusetts. For check-ups, we both return to the East Coast.

The entire period, Mark, Maya, and I lived in a room with en-suite bathroom and a makeshift “kitchen” in Newburyport, Massachusetts. Zesty was parked in the driveway, feeling neglected. Apart from getting a thorough cleaning inside and out and having a few parts replaced or fixed. No diesel cost, but May is when our annual camper insurance is due, generally making it the most expensive month of the year.

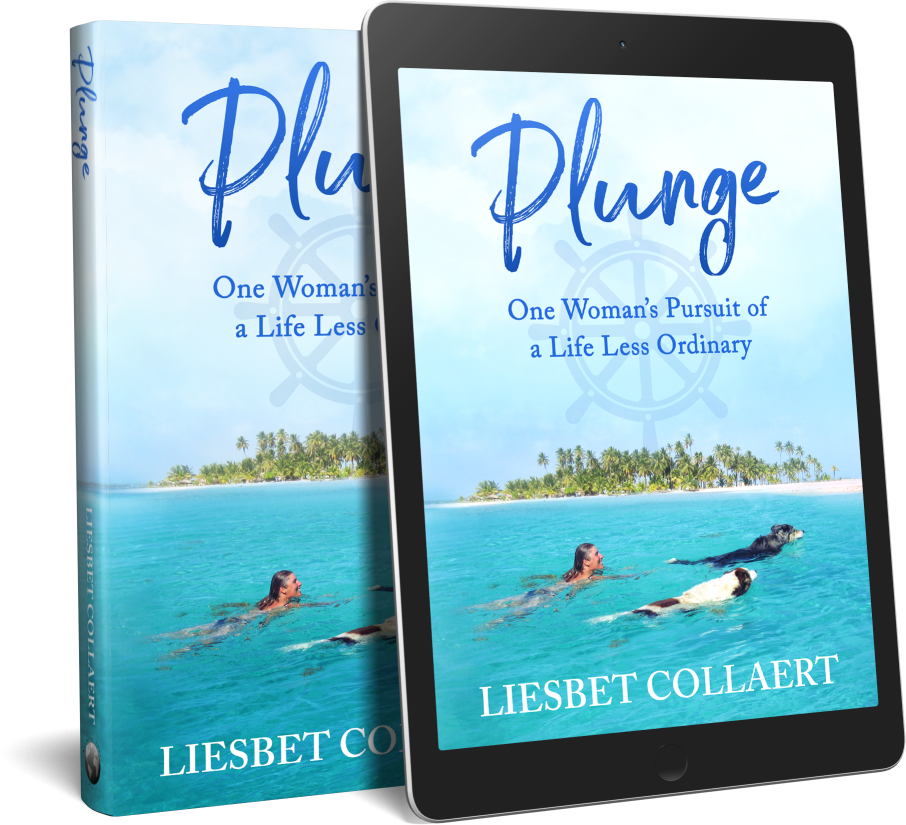

The weather wasn’t great. Being cooped up affects Mark more than me. I’m always busy with one or another writing or editing project (or attempting to make headway with my travel memoir – choosing an editor last month), happy with prolonged computer time. Walks with Maya in town involved crossing the road often to avoid pedestrians and keeping at least 6 feet distance when passing on the trails.

Mark found a forested, dog-friendly park ten minutes away from our home base, so he often drove Maya there for a hike. Her itchiness has improved since Florida, but we needed another bottle of Apoquel, which set us back $175 for 100 pills. It’s the cheapest option for this anti-itch medicine. Other “extra” expenses in May included flowers for my mother-in-law and one take-out dinner from a local burger joint.

As often, our camper van is the most expensive category in this monthly report, but June should be better!

May 2020 Overview:

Camper (insurance: $1118; maintenance: $294):

Groceries:

Dog (drugs: $175; treats: $8):

Utilities (phone):

Dining out:

Gifts (Mother’s Day):

Clothing (flip flops Mark)

Household (propane outdoor grill):

Postage:

Alcohol:

Accommodation:

TOTAL:

$1,412

$327

$183

$35

$20

$18

$11

$8

$1

$0

$0

———

$ 2,015

To learn what other full-time nomads spend each month, check out the expense blogs of our vanlife friends Duwan and Greg at Make Like An Ape Man.

June 7, 2020 at 12:11

WoW! Thats expensive meds for Maya! We had a Golden Retriever that had itchy skin issues and our vet at the time recommended Avo Derm dog food. Within a week he completely stopped scratching. He was on that diet for over 10 years.

See if you can get a sample to try it. https://www.avodermnatural.com/

Cheers!

June 7, 2020 at 12:18

Yep, the Apoquel is expensive, as she needs a pill a day. But, it generally helps. Thanks for the food tip, but we’ve deducted that Maya’s itchiness is environmental – allergies to whatever is in the air, or grass, or… (We tried the diet approach when we first adopted her.) Since we move locations so often and since testing to find out what exactly she is allergic to is extensive, expensive, and would require shots for the rest of her life, we’ve resulted to the medicine. We hope (and think), we might be able to wean her off in the desert southwest, whenever we return there.

July 8, 2020 at 13:42

Sounds like you got it covered. Good luck!

July 9, 2020 at 09:55

Thanks! It’s all environmental. So far, so good in Massachusetts at the moment. 🙂

June 7, 2020 at 15:14

Just to keep that ‘high’ cost in perspective, it’s still really cheap! I won’t tell you what mine is. Expensive med for Maya but dogs are always worth it.

June 8, 2020 at 07:20

That’s so true, Jacqui, our dogs are worth whatever they need to be happy and healthy. Our frugalness goes straight out the window when it comes to that (and being with friends). 🙂 Utilities and rent/mortgage are big ticket items for people living in a house. I think that’s why our costs are so manageable; we don’t have any accommodation expenses.

June 7, 2020 at 15:27

If not for the insurance, it would’ve been a low month. At least you had no travel expenses on top of that.

June 8, 2020 at 07:23

True about the travel expenses, Alex. Being stationary has its advantages. 🙂 Insurance (for us) has always been expensive and Difficult to swallow, always in May, but we wouldn’t feel comfortable without it. Plus, I don’t think it’s legal to not have any when it comes to vehicles in the US. The problem in MA is that there’s no competition to insure campers. Only one company provides it! On our boat, the cost was even higher, but insurance is not mandatory. You have no idea how much we “lost” with that over eight years.

June 7, 2020 at 15:39

Ah, puppies. So much love, so much budget destruction. 🙂

June 8, 2020 at 08:43

Haha, “budget destruction”! I love it. We’ve had two big rescue dogs on our sailing and RVing travels before (imagine carrying all that food), but I never blinked at the cost then. Now, with one dog, life sure seems more expansive! Inflation and meds, is my guess. But, as you know, they’re so worth it. 🙂

June 7, 2020 at 15:44

Happy adoptiversary to Maya! That insurance payment must hurt (it does us also) but the alternative could be so much worse. I’m impressed with the $0 for alcohol… we decided that wine with dinner most evenings is our therapy (just kidding… sort of).

June 7, 2020 at 16:21

It’s sad to hear the cost of medication is high for animals too, Liesbet. Glad Mark got some knew flip flops. I’m nodding in agreement to the comment by Janis about wine. 🙂

June 8, 2020 at 08:49

There is health insurance available for dogs, Jill, but we feel that yearly cost is higher than what we would spend out of pocket for Maya. Did you notice we spent ten bucks on flip flops and not the usual $1 or $2? Mark splurged on comfy ones. 🙂

June 8, 2020 at 18:26

LOL! Yes, I noticed that! I was going to say he could have gotten a pair at Dollar Tree. 🙂

June 10, 2020 at 16:45

Haha. That’s what I told him when we stopped at a Dollar Tree. But, they only had women’s models. Plus, since flip flops are our main shoe ware (ideally), they have to be comfortable and somewhat presentable. 🙂

June 10, 2020 at 17:50

Yeah, Dollar Tree flip flops would probably only last for one dog walk! 🙂

June 11, 2020 at 12:00

🙂

June 7, 2020 at 16:22

I agree, Janis. We all need a little “therapy.”

June 8, 2020 at 08:49

Yes to that. And, yes to wine. Or margaritas. 🙂

June 8, 2020 at 08:47

Maya says “thank you”, Janis! My hope is to write my next blog post about the pros and cons of dog ownership as digital nomads.

We rarely have $0 months for alcohol, so I’ve decided to add this category to the mix to impress everyone! 🙂 What it means is that we stocked up enough the previous month, bummed some wine off my mother-in-law, received a bottle here or there as a gift, or were extremely careful to make our wine and beer (and rum) last until the next month. In May, we actually bought more wine and beer on the last day of the month, so the charge wouldn’t go through until June. We can be sneaky!

We usually drink during the weekends and occasionally with dinner during the week. I like my wine as well. Mark often prefers beer.

June 7, 2020 at 19:31

That’s a big month for you. But it must be nice to get that auto insurance expense out of the way and not have to think about it again for another year.

Congrats on your Maya anniversary! I hate that she is itchy but she looks happy in the forest.

Your mother-in-law must have been very happy with her flower. It’s beautiful!

June 8, 2020 at 08:54

I’ve noticed that you guys cut your car insurance in monthly payments. Less painful that way! Even though I like putting these monthly reports together, it’s all relative and the bigger picture – the yearly expense report – is more accurate, I believe.

We often postpone a big shopping until the beginning of the next month – or the last day of the current month – to “move” the expenses. In reality, it’s all coming from the same source and is spent the same year. Yet, it feels good to have months of $800 or less. I now have a hard time believing that we used to have $400 months when on the boat. But, other months (provisioning or boat yard months), it would be well over $2,000. The annual overview (and cutting that in 12 for a monthly average) makes more sense…

June 7, 2020 at 21:53

Although the insurance bill is a nasty necessity, I suppose not having to pay any diesel this past month helps a bit. Hoping the pills continue to work for Maya. Although expensive, if they keep her comfortable then they are certainly worth every penny.

June 8, 2020 at 08:57

In general, we’ve had success with the Apoquel pills, Sue. It’s a miracle drug. In Florida, for some reason, the air made her itchy regardless. That was a tough three months. And, when we cut the daily pill in half, hoping it would have the same effect, we soon have to up the dose again. Hey, if we can stick to one pill a day, the medicine would “only” cost $640 a year. If we can keep using the same prescription. 🙂 But so worth it. We are all miserable when she’s extremely itchy scratchy!

June 7, 2020 at 23:26

Happy Anniversary of having, Maya. Has it been a full year already?!

Dogs are expernsive but so worth it. And much more cuddly and affectionate than insurance! 😀

June 8, 2020 at 08:59

Hi Donna! Thanks. Hard to believe it’s been a full year having Maya, right? I’m hoping to post a blog about that event – and traveling with a dog in a 19ft camper – this week: Adopting an adult dog, the pros and cons! Yes, dogs are much more cuddly than insurance (which is a necessary evil). They also wag more than insurance. 🙂

June 8, 2020 at 08:21

I see a small bump in your expenses because of your once-a-year camper insurance. And your daughter dog, well – still less expensive than a human child. I’d blush to have you see our monthly expenses, which I’m guessing are much less than others at the same stage of life.

Cheers to frugal living, Liesbet, Mark and Maya!

June 8, 2020 at 23:31

Wow, without the insurance you were on a good month! 🙂

June 10, 2020 at 16:48

Yep, the insurance “killed” us this past month. A normal car is much cheaper. But then, we’d need another form of accommodation…

June 9, 2020 at 16:54

It’s interesting to see that insurance is half your expenses for the month, but at least then you’re done for another year. I have a love-hate relationship with insurance – it amounts to fully half of our annual expenses; but I’m afraid to let it lapse… just in case.

Glad you’ve found some dog-friendly hiking trails to preserve everyone’s sanity! 🙂

June 10, 2020 at 16:51

Hi Diane! Wow, half of the year’s expenses for you? That’s pretty insane. That must include health insurance as well, even though I thought that this was not too bad in Canada.

Insurance is one of those “necessary evil” things. My adventurous self would rather skip it. But, my “Murphy’s Law” experiences and “Fear of the bad luck”-principle encourage me to play it safe and pay up! Peace of mind is a wonderful thing! 🙂

June 10, 2020 at 17:48

I hear you 😉

June 10, 2020 at 20:49

Yes, we pay for additional health insurance that covers portions of prescription drugs, physiotherapy, ambulance services, and other things that aren’t covered under our universal health care plan. The rest of the insurance is automobile, house, life, disability, and long-term care. I resent paying such a huge amount of money for something I might never use; but just one stroke of bad luck would make it pay for itself. It’s one of those situations where you hope you never get your money’s worth! 😉

June 11, 2020 at 12:03

Talk about a contradiction: paying a lot for something you don’t want to use. Ha! That almost warrants a blog post, Diane. 🙂 By the way, we have had to use the US health care system for such a “stroke of bad luck” a few years ago. Crazy story for another day.

June 12, 2020 at 08:22

As always, an impressive and inspirational budget. My granddog has the “itchies” from allergies also. He’s allergic to grass, and of course loves rolling in it. Glad you found a pill to help Maya. Worth every cent! xo

June 12, 2020 at 11:49

Hi Pam! Oh, that’s too bad about your granddog, but at least the source of the itchiness is known. Apoquel might help him as well, as needed, not as a constant. Being allergic to grass is a toughie, though. 🙁 Yes, a comfortable dog is a happy dog is happy parents. 🙂

June 13, 2020 at 21:49

Hi Liesbet, I find the dynamics of a relationship interesting. Like you say, being cooped up affects Mark more than you. Darn, huge expense on the anti-itch medicine. I am always in awe of how you “name it to claim it.” I think I have used this phrase before. You are not in denial with your expenses. Reading through the comments, I agree how when there is no competition for insurance, the rates can be excessive. I also got involved in the wine conversation. 🙂

June 19, 2020 at 11:45

I now know how it feels to be itchy like Maya, Erica, as I’ve been dealing with an excessive, crazy itchy rash the last two weeks. I almost took Maya’s medicine! 🙂

The wine is flowing freely here as well, these days, as we are visiting friends throughout the northern states. Our alcohol bill will be high in June!

If you are curious about relationships and how they live or die in lifestyles like ours, you will enjoy reading my memoir whenever it comes out, as that’s the main focus and theme of it. Not so easy to live 24/7 in small spaces…

June 16, 2020 at 05:51

Liesbet, the costs of insurance are eye watering, but a necessary evil. Poor Maya, having itchy skin is no fun at all, but I am glad the medication helps. Your budget for May still impressive, staying put has certainly helped your budget, although not so good for Mark’s sanity.

June 19, 2020 at 12:09

Gilda, you understand the “itchy feet” syndrome. I usually suffer from it big time, but because I have so many projects I commit to and enjoy working on, I’m fine being stuck inside for weeks at a time. And, I enjoy the creature comforts once in a while. Mark has been feeling claustrophobic in the room, especially since it was too cold to be outside. All is better now, especially since we “escaped” and hit the road again for a few weeks. Everyone is happier now. 🙂

June 16, 2020 at 13:24

Liesbet, you guys are amazing! You know how much we like to keep things simple and frugal – well, you guys are always an inspiration. Thanks again for sharing your expenses. ~Terri

June 19, 2020 at 12:13

Hi Terri! Thanks for reading and commenting. We love the minimalistic idea, as you know. Simple is good. I don’t do well with “complicated”, gadgets, and lots of stuff. That creates headaches and responsibilities and commitments. It’s why I don’t have a phone and find ways around having to change that. You guys are so awesome with the way you choose to live your life and with your priorities. The inspiration is mutual! 🙂

July 1, 2020 at 15:34

We have expensive months too. This month it was property taxes, house insurance, mortgage payment, income tax (usually payable in April but deferred because of the corona virus), and early bird seasons ski passes. Yikes!

Jude

July 1, 2020 at 21:30

Wow, that sounds like a lot of money, Jude. It’s overwhelming when giant expenses like that all “hit” in the same month. Every time I think about settling down and having a small house, thoughts about expenses like the ones you mention make me cringe. Living in a camper makes those things very easy! 🙂